My Money Means For Teachers

Financial Literacy Education Program

Welcome, dedicated Teachers, Let’s talk Financial Literacy in schools!

As educators, you have the power to equip your students with essential life skills that extend far beyond the classroom. By incorporating financial literacy into your curriculum, you can empower your students to navigate the complex world of money confidently. At My Money Means, we understand the importance of preparing students for a financially savvy future, and we are here to support you every step of the way.

Discover a wealth of engaging resources, interactive lessons, and comprehensive tools that have been thoughtfully designed to make financial literacy come alive in your classroom. Our resources cater to various age groups and learning styles, ensuring that every student can actively participate and grasp the concepts effectively. From budgeting and saving to investing and entrepreneurship, our curriculum covers a wide range of topics, giving your students a well-rounded understanding of personal finance.

By integrating financial education into your teaching, you are giving your students a head start in life. These crucial skills will empower them to make informed financial decisions, set and achieve financial goals, and navigate the challenges of the real world with confidence.

Take the first step towards shaping their financial success today! Access our empowering resources and transform your classroom into a hub of financial literacy. Together, let’s ignite the financial potential in your students and provide them with the tools they need to thrive in an increasingly complex financial landscape. Click here to get started!

The Importance of Teaching Financial Literacy for Students

Financial literacy for students is of utmost importance in today’s ever-changing world.

As our society becomes increasingly complex and interconnected, the ability to navigate personal finances is a crucial life skill. By teaching financial literacy in schools, we are equipping students with the knowledge and tools they need to make informed decisions and manage their money effectively.

Financial literacy empowers students to understand the value of money, budget their income, differentiate between needs and wants, and make thoughtful spending choices. It helps them grasp the concept of saving and investing for the future, enabling them to set achievable financial goals. Moreover, financial literacy teaches students about credit, debt, and the importance of responsible borrowing, preparing them to navigate the world of loans and financial obligations wisely.

Beyond individual benefits, financial literacy has broader societal implications. When students are financially literate, they are better equipped to contribute positively to the economy. They become informed consumers, savvy investors, and potentially successful entrepreneurs. By instilling financial literacy skills early on, we are fostering a generation of financially responsible individuals who can make a positive impact on their communities.

Teaching financial literacy in schools provides students with practical, real-world knowledge that extends far beyond their academic years. It equips them with the confidence and competence needed to manage their finances responsibly and make informed decisions throughout their lives. Let’s prioritise the importance of financial literacy in schools and empower our students to build a solid foundation for financial success.

The Importance of Financial Education in Schools

Financial education in schools holds immense importance as it equips students with crucial life and money skills, preparing them for a successful future. As teachers and educators, you have the opportunity to foster a positive learning environment where students can develop a strong foundation in financial literacy. By integrating financial education into your curriculum, you are not only teaching students about money but also providing them with essential life skills that will serve them well beyond the classroom.

By incorporating financial education, you empower students to make informed decisions regarding their personal finances. They learn how to manage money, budget effectively, save for their goals, and understand the implications of credit and debt. These skills lay the groundwork for financial independence and responsible decision-making.

Furthermore, financial education helps students develop critical thinking skills as they evaluate financial options and assess the risks and benefits of various financial choices. It fosters problem-solving abilities, as they navigate real-world scenarios and make informed judgments. By tackling practical financial challenges, students become better equipped to handle the complexities of adult life.

Creating a positive learning environment around financial education not only equips students with essential life skills but also promotes confidence, self-reliance, and a sense of empowerment. By imparting financial knowledge and fostering a positive mindset towards money management, you provide students with tools to thrive in an increasingly complex and interconnected world.

As teachers and educators, you have the power to shape the financial future of your students. By integrating financial education into your teaching practices, you help students develop critical life skills, enabling them to make informed decisions, achieve financial well-being, and pursue their dreams. Embrace the importance of financial education in schools and foster a positive learning environment that equips students with the knowledge and skills to navigate the complexities of life and money successfully.

Teaching Money Management in Schools with My Money Means

Transforming financial education starts with empowering teachers and educators to teach money management effectively with the help of My Money Means.

Are you passionate about teaching money management in schools and equipping your students with essential financial skills?

Look no further than My Money Means for a comprehensive suite of tools and resources designed specifically for educators like you. Our engaging and interactive materials make teaching money management a breeze, providing you with the resources you need to create meaningful learning experiences.

From lesson plans and activities to worksheets and games, our extensive collection covers various age groups and learning styles.

With My Money Means, you can confidently introduce financial literacy into your curriculum, empowering your students to develop lifelong money management skills.

Join our community of educators and access our valuable resources to make teaching money management in schools both effective and enjoyable.

Support Students Financial Education With My Money Means

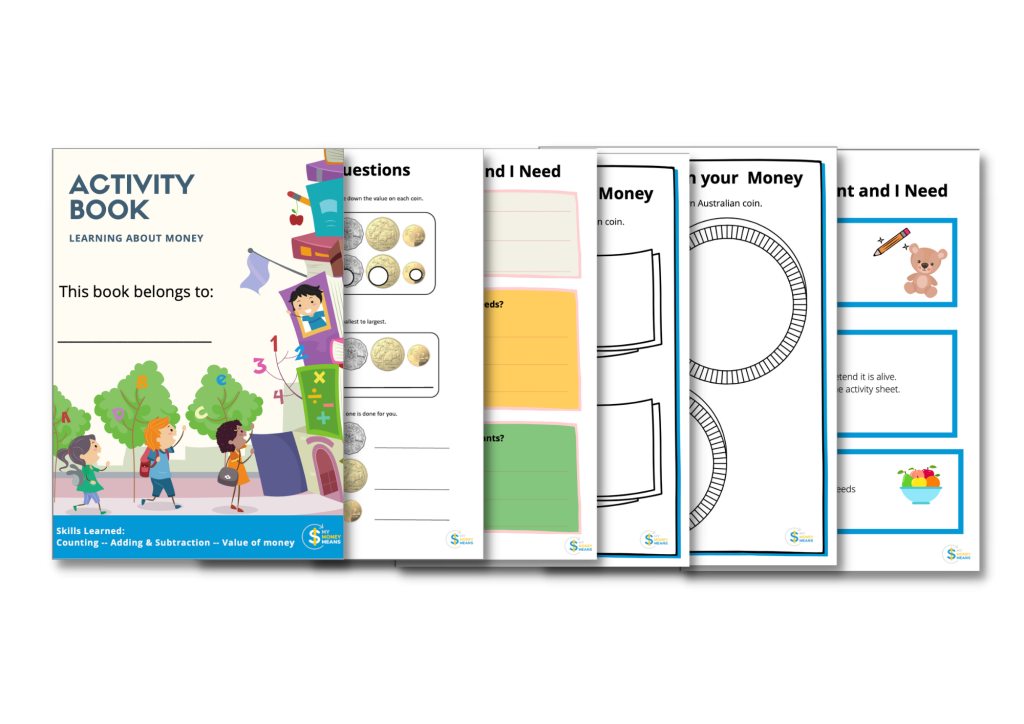

Grab Your Free Copy - My Money Means Activity Book