My Money Means For Parents

Financial Literacy For Your Children

Based in Australia

Welcome Parents and Caregivers,

Invest in Your Child’s Future with My Money Means.

As a parent, you want to provide your child with every opportunity for success. That’s why it’s never too early to start teaching them the value of money and the importance of financial literacy. At My Money Means, we understand the significance of equipping your child with the skills they need to navigate the complex world of finance.

Our comprehensive resources and expert guidance make financial education engaging, accessible, and fun for children of all ages. From budgeting and saving to investing and entrepreneurship, we offer a wide range of interactive tools and age-appropriate materials to help your child develop a strong financial foundation.

By encouraging your children to learn about money, you are setting them up for a bright future. With My Money Means, you can help your children develop the financial literacy skills they need to thrive in today’s world. Start your child’s financial education journey today!

Click below to start their money management journey today!

Real-World Financial Skills: Personal Finance for Kids Made Easy

At My Money Means, we understand the importance of personal finance for kids and the lifelong impact it can have.

That’s why we’re committed to providing your child with a comprehensive understanding of real-world financial skills. Our resources go beyond theoretical knowledge, equipping children with practical tools that they can apply in real-world scenarios.

As a parent, you play a crucial role in this process by demonstrating and encouraging your child to use and learn these skills in everyday situations.

Together, we can empower your child to make smart financial decisions, fostering their independence and setting them up for success in the real world.

The Best Age to Teach Kids About Money:

Building a Strong Financial Foundation

As parents, you may wonder about the best age to teach kids about money.

The truth is, it’s never too early to start laying the foundation for financial literacy. Even at a young age, children can begin learning basic concepts like counting, saving, and sharing.

As they grow older, around 4 to 7 years old, they can grasp the concept of money and develop essential skills such as recognising coins and understanding the value of different denominations.

By the ages of 8 to 12, children can expand their knowledge to include budgeting, goal setting, and making responsible spending choices. This stage is crucial as they start to receive pocket money or allowances.

By the teenage years, around 13 to 18, children can learn about more complex topics like earning money through part-time jobs, managing bank accounts, and making informed decisions about saving and investing.

Introducing these concepts gradually and adapting the lessons to their age and stage of development ensures that children build a strong financial foundation. By starting early and providing age-appropriate financial education, you are setting your children up for a lifetime of financial success.

The Power of Learning About Money:

Parents as Role Models in Shaping Financial Values

Parents play a substantial role in shaping their children’s perception and use of money.

Learning about money extends beyond the classroom, and it is within the home environment that children observe and absorb financial habits and values. By openly discussing money matters, involving children in budgeting decisions, and demonstrating responsible spending and saving behaviors, parents can instill positive attitudes towards money.

Additionally, providing opportunities for children to earn and manage their own money, such as through chores or part-time jobs, fosters a sense of responsibility and financial independence.

As a parent, you have a unique opportunity to be a role model and guide your children towards a healthy and informed relationship with money. Embrace this important responsibility and empower your children with essential financial skills that will benefit them throughout their lives.

Financial Education Resources For Home Schoolers

As a homeschooling parent, you understand the importance of equipping your children with essential life skills.

Our dedicated platform offers a wide range of engaging and age-appropriate materials, curriculum guides, interactive games, and expert advice to foster a solid foundation in financial literacy. From understanding budgeting and saving to exploring the intricacies of investments and entrepreneurship, our resources cater to various age groups and learning styles.

Join our community of homeschooling families and empower your children to make informed financial decisions that will shape their future success. Start their money education journey today

Support Your Childs Learning With My Money Means

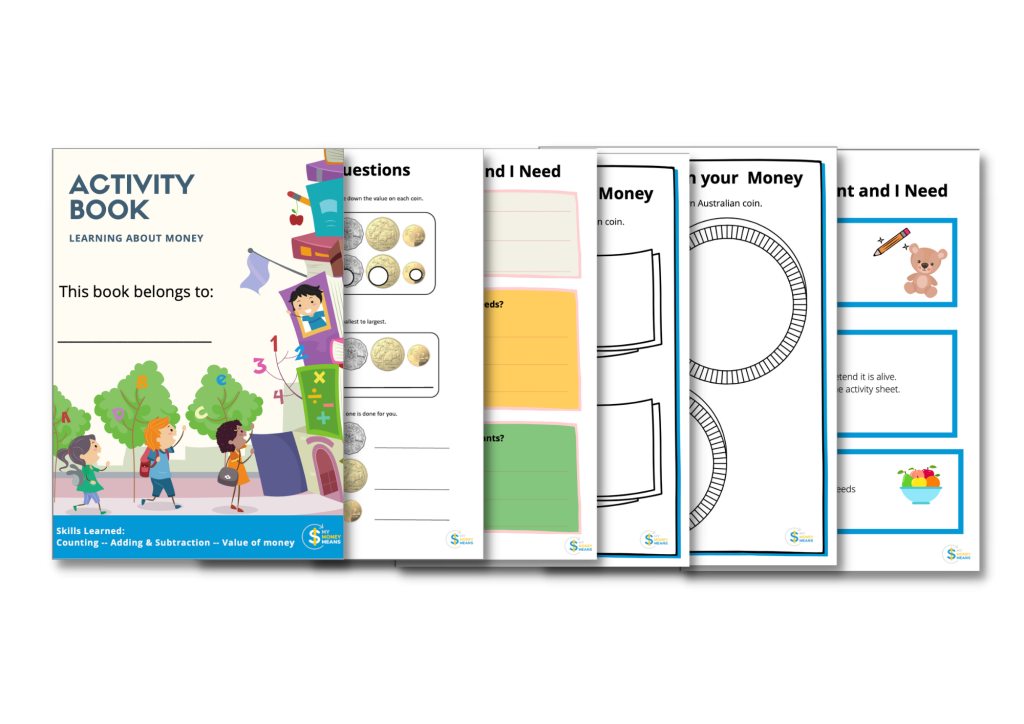

Grab Your Free Copy - My Money Means Activity Book